Tokenization of Real-World Assets: Assessing Market Sentiment

The tokenization of real-world assets and securities has become a hot topic in capital markets recently. Larry Fink, the CEO of BlackRock has said that the next generation for markets will be tokenization of securities[1]. Other leading financial services firms such as Goldman Sachs, JP Morgan and Citi are actively working in the space with the latter claiming that tokenization of real-world assets will become the next ‘killer use-case’[2]

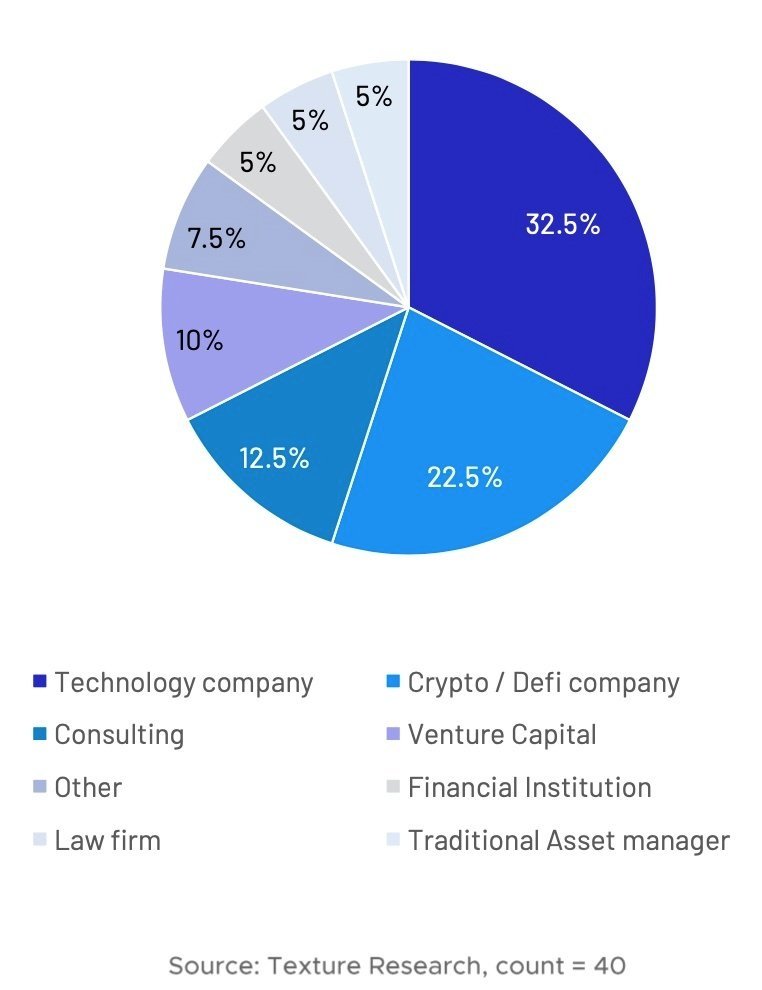

Organization Type

To gain a better understanding of perceptions and attitudes towards tokenized real-world assets (RWA), Texture Capital conducted a survey of 40 executives across fintech, finance and web3. The executives invited to take part have some degree of exposure to the blockchain space and can be expected to have informed opinions about the topic.

Increasing Adoption Expected

Tokenization of real-world assets is likely to see increased adoption over the next 24 months

Most participants strongly agreed that tokenization of real-world assets is likely to see increased adoption over the next 24 months. In fact, none of the executives we contacted disagreed with that statement, indicating strong positive sentiment to tokenized RWA.

Assessing the current value of tokenized securities and RWA outstanding is complicated as adoption is occurring globally, without a standardized way of identifying assets as being tokenized. Security Token Market, a leading data and analytics company in the space, estimates that there is currently $16.5 billion of security tokens trading in the secondary market[3]. This is likely an underestimate of the true activity in the space, as it excludes asset tokenization that is currently occurring on permissioned networks between banks. For example, JP Morgan claims to have processed almost $700 billion of tokenized short term loans, and Broadridge is currently using a blockchain based repo platform for $1 trillion per month in transactions[4].

Looking forward, it is clear that market participants expect strong growth from here. A recent analysis by Boston Consulting Group and the World Economic Forum suggests that the tokenization of global illiquid assets is estimated to be a $16trillion business opportunity by 2030[5], and Citi is forecasting there will be $4 to $5 trillion of tokenized digital securities by 2030[6].

Key Advantages of Tokenizes RWA[7]

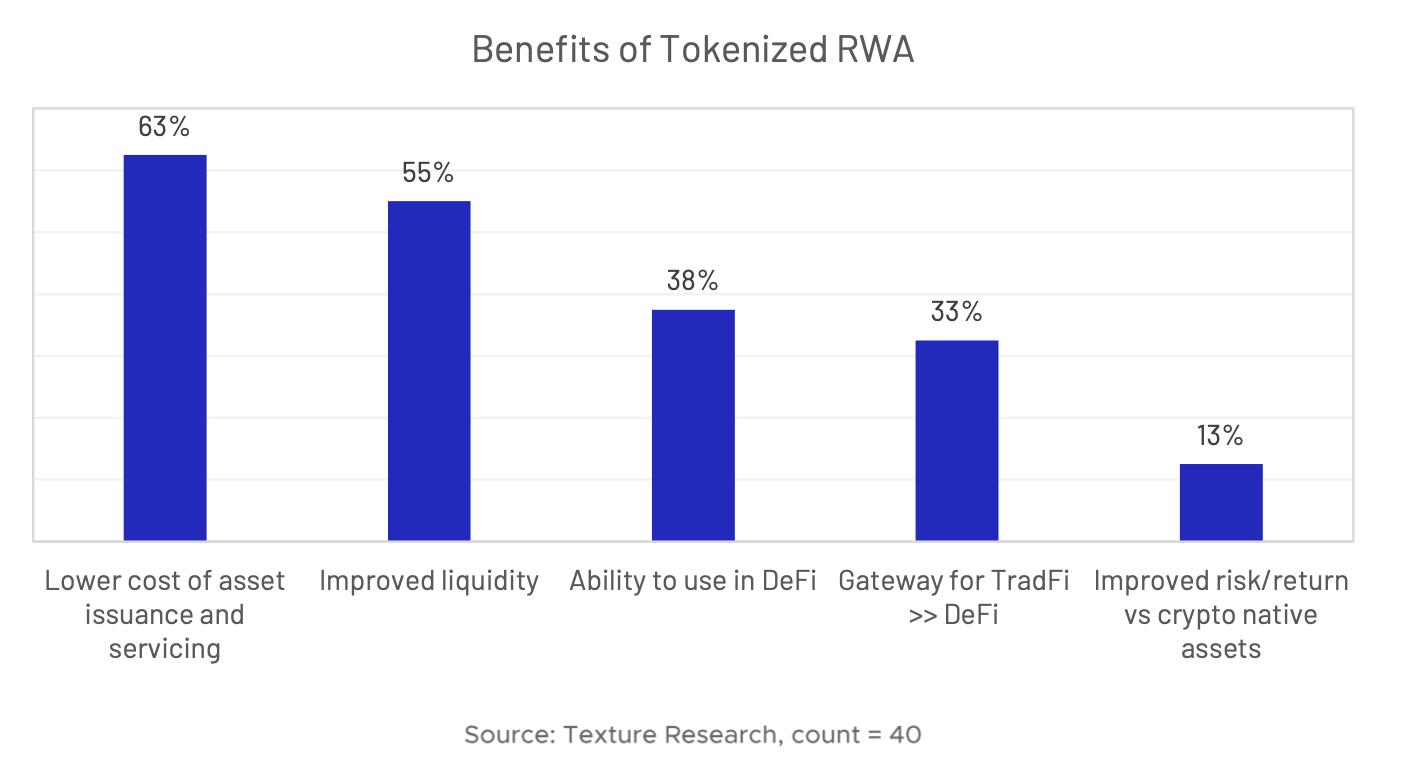

The top perceived benefit of tokenized real-world assets is that they can deliver a lower cost of asset issuance and servicing according to our survey. There are various ways this can be achieved: a distributed ledger provides a single source of truth for the different parties involved in the transaction to reference and collaborate together, without the need for off-chain reconciliation; smart contracts are able to automate securities servicing such as dividend payments, voting, escrow arrangements and collateral management; and a technical infrastructure, once designed, can easily be reused for future issuances.

The focus of most initiatives around tokenization of real-world assets is in alternative and private markets which are traditionally much more opaque and less liquid than public markets. Blockchain technology can improve transparency in private markets through its distributed ledger accessible to all participants that provides a complete record of ownership and transaction history. On top of this, smart contracts can streamline workflows in secondary markets, potentially leading to improved liquidity provision.

Over a third of participants cited the ability to use tokenized RWA as collateral in DeFi as a key benefit. Well-known DeFi protocols that incorporate RWA include Aave, Centrifuge, and Maker. In simple terms a DeFi lending protocol emulates the functions of a bank on blockchain. For example, if you want to borrow money from a bank for a mortgage, the bank will take a lien on your house as collateral and lend you the money at some interest rate. Now let’s say you have a tokenized real estate asset; you could deposit that into a DeFi lending protocol, and withdrawal stablecoin. The lender of the stablecoin would receive interest with the DeFi protocol taking a cut.

One in three participants were enthusiastic about the potential for tokenization of RWA to be a gateway between TradFi and DeFi. If the crypto space is to grow and achieve the true potential of re-imagining all financial markets – a stated goal of many – then the divide between regulated capital markets and the less regulated crypto markets will need to be bridged. Tokenized RWA does this by combining the technology from crypto with the assets and regulatory umbrella from traditional capital markets.

While tokenized RWA may, in reality, offer a better risk return profile than crypto native assets, this was not seen as a key driver of adoption. Crypto assets have experienced significant returns over the last 15 years, but also significant volatility. At the same time stablecoins have lower volatility (of course), but do not explicitly have any yield. In contrast, a tokenized T Bill would offer lower volatility and pays interest – even more so in the current high interest rate environment. Some crypto companies are looking to transfer these benefits to DeFi. For example, Ondo Finance which recently launched, is offering a form of tokenized T Bills to users who deposit stablecoins into their platform [8]. In this way, the crypto community and holders of stablecoins are able to earn a yield on their stablecoins, without converting to fiat and taking the assets out of DeFi. With T Bills currently yielding over 5%, vs about 2.5% on the leading DeFi protocols[9] this can be a compelling value proposition.

Preferred Real-World Assets

‘Real-World Assets’ is a broad term comprising many different distinct investible asset classes.

Real Estate was widely seen as the most popular asset class that participants would like to see tokenized on chain. This includes physical real estate such as title, and real estate securities, such as REITs or LLC interests. While there can be recordkeeping benefits to utilizing blockchain for recording title, most investments in real estate are through some kind of security. Real estate is one of the largest asset classes in the world [10] and tokenization has the potential of making this asset class more liquid and accessible. The St Regis at Aspen was one of the very first security tokens to be offered in 2018, and there are many companies bringing tokenized real estate assets to market including QuantmRE, SolidBlock, AKRU, DigiShares, and Red Swan.

Alternative Assets was seen by two fifths of respondents a promising asset class to tokenize. There is a growing trend to democratize access to investments such as fine art and music royalties , which have typically been out of reach of the average investor. Blockchain technology is already underpinning fractional marketplaces such as ANote Music, Freeport and others.

Private market assets such as Private Company Shares, Private Equity, and Private Credit were the next most popular choice. These are large asset classes, typically only available to institutional investors, and illiquid. Tokenization has the potential to open up these markets and enable improved liquidity in secondary markets.

The most relevant products are the ones that are the most complex, illiquid, and difficult to implement over traditional rails. So structured products, private credit, trade finance, and similar industries seem like the best opportunity for RWA.

- Crypto company executive

Structured Products was only selected by one fifth of participants, but they felt the complex nature of these products could benefit from digitization and automation through blockchain and smart contracts.

Yield-bearing fixed income assets such as Money Market Funds and T-Bills, were favored by just 15% of participants. This is somewhat surprising, given that this is already a fairly active segment with companies including Arca, Franklin and WisdomTree having registered public offerings of these types of products. In addition, these products can be utilized in DeFi protocols as discussed previously.

Commodities and Public Equities were the least popular choices. Possible reasons for this are that commodities are physical assets which do not lend themselves well to digitization, and public equities already have an efficient, well developed market structure.

Challenges

A lack of regulated digital asset market infrastructure is considered the top challenge for tokenization of RWA. However, digital asset securities broker dealers like Texture Capital are able to support issuance and trading of tokenized securities and real-world assets.

Just under half of respondents felt that there was a lack of regulatory clarity or that it was difficult ensuring compliance with regulations. In our view, while we agree that the regulators could be more open to regulatorily compliant companies who share their goals of improving capital formation, protecting investors, and building efficient markets, there is a workable path for any issuer who wants to tokenize real-world assets and facilitate new investment marketplaces.

A lack of liquidity in the space is indeed a challenge, as noted by 43% of executives. Part of the issue is that most tokenization is happening in asset classes that are inherently illiquid, such as private equity or private credit. For example, public equities can turnover 200% of their total market capitalization per year, whereas some private markets have virtually no secondary market liquidity, or in the low single digital percent . In this context, if tokenization can enable a turnover increase to 15%, it is still a win [12].

One quarter felt that service providers such as custodians and transfer agents could increase costs. This may be a factor right now, but costs are likely to come down as the industry scales. Finally, 18% felt that there was a lack of quality assets being tokenized. That may have been an issue when the space was in its infancy, but we are increasingly seeing more mature issuers coming to the market with more attractive deals.

Other constraints on liquidity are the one-year lockup enforced for many US Reg D private placements and a lack of market markers. Market makers, whose business model relies on tightly controlling risk, are likely to stay out of markets where there is a risk that they would have to hold a position for a long period of time before liquidating. However, we feel that market makers will emerge for tokenized securities marketplaces where there are a large number of more active investors (for example, retail fractionalized marketplaces).

Blockchains for RWA

Tokenized real-world assets are inherently different from crypto. For a start many such assets are structured as securities or another type of financial instrument, and they are also not bearer assets. The asset issuers may need to file a registration statement or some other regulatory filing; transactions in tokenized RWA will likely have to be facilitated through a regulated intermediary like Texture Capital; and participants in a platform for tokenized RWA will need to go through KYC and AML screening. This has implications for the most suitable type of blockchain.

Over three quarters of executives felt that tokenized RWA best belong on either a permissioned blockchain or a permissioned subnet. Even among crypto companies there was a strong preference for some kind of permissioned environment, which is somewhat surprising given that crypto companies tend to favor public blockchain.

However, given the current regulatory environment, a permissioned blockchain (or subnet), is likely to get far less scrutiny from the SEC, and is arguably the better choice, at least for now.

Ethereum was considered the most suitable blockchain fabric for tokenizing RWA. This is not too surprising as it is the most established layer 1 supporting smart contracts, has the largest developer network, and the recent move to proof-of-stake means that transaction fees are no longer punitive. Polygon and Avalanche were the next most popular public blockchains, cited by almost a quarter of participants. Note: Ethereum, Polygon and Avalanche all support some kind of permissioning.

Provenance and DAML are two permissioned blockchains that have been designed for regulated financial market participants and were chosen by a combined 13% of participants. Provenance is linked with fintech company Figure and currently has a large number of tokenized HELOCs and other assets on the chain. DAML is one of the OGs in the blockchain space and recently announced the Canton network with 30 leading financial services companies including Goldman Sachs, Cboe, BNP Paribas, Paxos and others.

Driving Adoption

The growth in adoption of tokenized real-world assets will be driven by traditional financial institutions, either in combination with crypto native companies or on their own. Only 18% of respondents felt that crypto companies alone would be able to drive adoption.

Incumbent financial companies have the resources, the expertise, and the distribution necessary to successfully drive tokenization forward. We are already seeing leading investment banks such as Goldman Sachs, JP Morgan and Société Générale incubate dedicated teams and have begun issuing tokenized products.

Final Thoughts

There is broad consensus within the FinTech and digital asset community that tokenization of real-world assets is likely to see strong adoption going forward, with market participants seeing the key benefits as lower costs and improved liquidity.

Challenges remain, including the perception that there is a lack of regulated digital asset market infrastructure and with compliance with the regulations. In reality it is currently possible (at least in the US) to compliantly issue tokenized real-world assets through regulated intermediaries like Texture Capital with securities trading on an Alternative Trading System.

The crypto community cannot spawn a vibrant ecosystem for tokenized real-world assets without participation from incumbent financial services players. These entities are more risk averse and slower moving but are already well along on their journey. We are already seeing real estate and alternative assets moving on chain, often via fractional marketplaces, and going forward as the established financial institutions get more comfortable, we will see a broad range of asset classes moving on chain.

Institutions who are considering tokenizing an existing asset or raising capital via a security token offering, will need to establish relationships with custodians, transfer agents and broker dealers who have expertise in digital securities and tokenization. While the idea of tokenizing real-world assets may sound daunting, there is a clear path forward, and early adopters will be able to develop a competitive advantage over their competitors.

[1] https://finance.yahoo.com/news/blackrock-ceo-says-next-generation-120411520.html [2] https://cointelegraph.com/news/killer-use-case-citi-says-trillions-in-assets-could-be-tokenized-by-2030[3] https://stomarket.com/market[4]See reporting on JP Morgan, and Broadridge. Also note that these tokenized assets are short term in nature and most of which are no longer outstanding.[5] https://web-assets.bcg.com/1e/a2/5b5f2b7e42dfad2cb3113a291222/on-chain-asset-tokenization.pdf[6] https://cointelegraph.com/news/killer-use-case-citi-says-trillions-in-assets-could-be-tokenized-by-2030[7] Blockchain technology is unproven in financial markets and there is no guarantee that these benefits will arise.[8] https://www.prnewswire.com/news-releases/ondo-finance-announces-new-token-ommf-providing-tokenized-exposure-to-us-money-market-funds-targeting-100-billion-stablecoin-market-301796332.html[9]As of 5/30/2023. Data from defillama.com and Marketwatch.[10] https://www.savills.com/impacts/market-trends/the-total-value-of-global-real-estate.html[11] https://www.entrepreneur.com/en-au/finance/democratizing-alternative-investments-a-bright-future-is/424423[12] Based on Texture Capital proprietary analysis[13] JP Morgan has created Onyx Digital Assets, SocGen has created Forge and Goldman recently announced their Digital Asset Platform (DAP).